I did, however, find this article in the Indianapolis News:

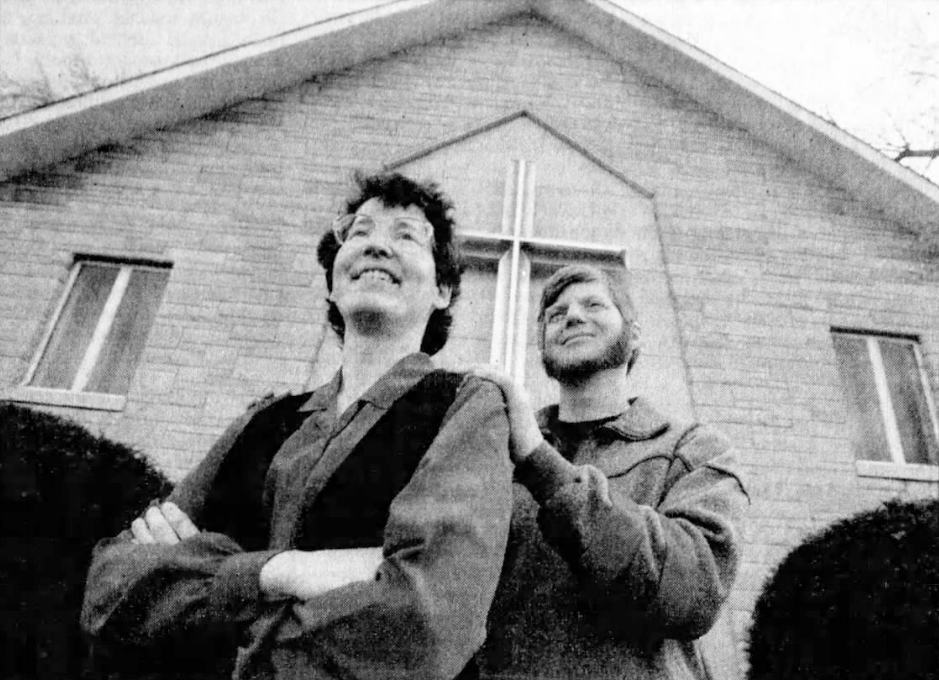

“Standing Firm: Beverly Weaver and her husband, Duane Grady, pastors of Northview Church of the Brethren, have continued their tax protest despite IRS liens on their savings.”

Waging peace for husband-wife pastoral team means fighting feds by rejecting part of tax bill

Couple is part of national network advocating diversion of revenue from defense to social programs.

by Judith Cebula

Staff WriterBeverly Weaver and Duane Grady believe the U.S. government has the power to do good — to help educate children, feed the hungry, and take care of the elderly and the sick.

But because of their Christian commitment to peace, they oppose the government’s power to wage war. So they don’t pay taxes that support the U.S. Department of Defense, veterans benefits, and government debt related to defense spending.

It’s a step this married couple has taken annually for nearly 15 years. According to their calculations, roughly half of their federal income tax support these programs, so they withhold that amount each year.

Instead of paying the government, they donate the amount to the Iowa Peace Network, an inter-faith group dedicated to peace activism and education, Grady said.

Pacifist history

Together Grady and Weaver pastor Northview Church of the Brethren on the Northeastside. Along with Quakers and Mennonites, the Church of the Brethren is known as a peace church because pacifism has been a core teaching throughout its nearly 300-year history.

Weaver and Grady are among an estimated 8,000 to 10,000 Americans who withhold a portion of their tax dollars because of peace activism, said Karen Marysdaughter, director of the National War Tax Resistance Coordinating Committee.

In , the couple learned that the Internal Revenue Service had put a lien on their savings account to collect $2,200 in back taxes plus interest and penalties. Grady and Weaver aren’t fighting the lien.

“This is part of the price of my belief,” Grady said. “I don’t oppose taxes. I just oppose the way taxes are being used.”

This is the third time that the IRS has come calling to collect from the couple. Each time, Weaver and Grady have paid the taxes themselves and received help from other war tax resisters in paying the fines and interest on the taxes.

They belong to a national coalition of resisters who pay into a relief fund. Grady and Weaver are requesting help this year. They have sent a copy of their tax return and the IRS collection notice to the director of the fund, along with a statement of their religious commitment to peace.

Based in Indiana

Ken Brown helped start the War Tax Resisters Penalty Fund about 25 years ago. He directs the peace studies program at Manchester (Ind.) College, a Church of the Brethren affiliate.

Brown said about 300 people throughout the country are part of the network.

Fund members include Mennonites, Quakers and Brethren, mainline Protestants, Catholics, Jews, Buddhists, and peace activists of no religious affiliation.

In addition to supporting the War Tax Resisters Penalty Fund, Grady and Weaver also support the creation of a “peace tax fund.” It would require changes in U.S. tax laws to allow conscientious objectors to divert their tax dollars from war and defense program to humanitarian governmental projects.

“All of this is an effort to be a little more consistent in our faith,” Weaver said. “It’s an issue of not wanting to pay for war when I am praying for peace.”