This is the twentieth in a series of posts about war tax resistance as it was reported in back issues of Gospel Herald, journal of the (Old) Mennonite Church.

In , the Mennonite Church had the luxury of being by-standers as the General Conference Mennonite Church wrestled with the war tax issue, and in particular about whether to continue to withhold income taxes from the salaries of their employees who were conscientious objectors to military taxation (the Mennonite Church would get its own chance to wrestle with these issues a bit later on), at a special mid-triennium conference on the issue. Meanwhile, disgruntled conservative Mennonites met at the Smoketown Consultation, Peace Tax Fund advocates ramped up their campaign, and the New Call to Peacemaking pushed the Peace Churches to step up their game.

As a result, there was a plethora of war tax resistance-related content in Gospel Herald that year.

The issue of Gospel Herald quoted Don Kaufman on the war tax problem:

“The federal income tax is the chief link connecting each individual’s daily labor with the tremendous buildup for war,” Donald D. Kaufman observes in his new book, The Tax Dilemma: Praying for Peace, Paying for War (Herald Press: ). “Preoccupied as some citizens are with paying too much tax, I suggest that the crucial issue has to do with the purpose for which tax monies are used,” Kaufman maintains. “While a young person can be exempted from personally serving in the Armed Forces, no one is easily exempted from making contributions to the military leviathan.” In his book, Kaufman considers issue of the two kingdoms. After a brief examination of the biblical background, he traces the history of conscientious objection to war taxes. He discusses a dozen viable options which concerned Christians can use “to register our faithfulness to Jesus Christ as Lord and our opposition to corporate war making by the state within which we live.”

“The Bulletin of the Mennonite Biblical Seminaries” which was included as a supplement, announced that Henry Poettcker would be the new president of Mennonite Biblical Seminary:

[W]hat words can we say to our brother in his new responsibilities? Lawrence Burkholder in the consultation on taxes and war initiated an intriguing discussion on the manager (or the administrator) and the prophet and corporate responsibility. He observed that with only a few incidental references, "the Bible is almost solidly against those who assumed responsibility for institutional life" (a distressing word for a biblical scholar on his inauguration).

At the meeting of the Mennonite Board of Missions, it became clear that Mennonite Church agencies would also have to deal with the tax withholding question that was roiling the General Conference Mennonite Church:

Ray Horst reported that two staff members have said they would want to consider a personal response on war taxes should Mennonite Board of Missions seek alternatives to such withholdings. The directors acted to continue discussions with other Mennonite groups and Mennonite Church agencies on the war tax question.

In the issue, Carl Kreider offered simple living and charitable giving as war tax resistance techniques:

How to save taxes.

There has been much discussion about the appropriateness of paying for war as we pray for peace. Some have sought ways in which they can refuse to pay federal income taxes and thus give a concrete witness against the militarism which plagues the U.S. and many other countries of the world — even, alas, poor countries.

The focus on income taxes may obscure the fact that there are many other federal taxes which are also used to support the national defense establishment. In fact, in the personal income tax provided only about one half of the non-trust fund U.S. federal revenue. The other half came from a variety of sources such as the corporation income tax, excise taxes (on many items such as telephone service, air travel, automobile tires, gasoline, and especially alcohol and tobacco), estate and gift taxes, and customs duties.

Can we avoid paying these taxes? Not completely, but we can reduce the amount we pay by the simple device of not buying at all the things which are harmful and by reducing our expenditures for all other items by holding down our standard of living. The United States tax law is very generous in allowing deductions for making contributions to churches and charitable institutions. (The Canadian law is less generous.) Up to 50 percent of income may be deducted.

These charitable gifts will first of all reduce sharply the amount of federal income tax we pay — in some cases even avoiding the tax completely. But in the second place, since the gift to charity will reduce our remaining disposable income we will have reduced our standard of living and thus will have to pay less of the hidden taxes which also support the defense establishment. The corporation income tax, for example, is one third the size of the personal income tax.

Although the check to pay the corporation income tax is sent to the government by the corporation, rest assured the corporation will, if they possibly can, pass on the tax to the consumer in the form of higher prices for the things the corporation sells. If we don’t buy the product, we aren’t paying this tax.

Reducing our standard of living as a means of avoiding federal taxes has an important additional benefit. It is a powerful witness that we are disturbed by the disparities in wealth and income throughout the world. Our lives should demonstrate that we can get along without buying the multitude of things an affluent America deems important.

A report on an protest at Titan Ⅱ missile base noted that “Also scheduled for the same day will be a nonviolent protest at the Wichita offices of the Internal Revenue Service, designed to draw attention to tax money being used for military expenditures…” And a separate report on a protest at Rocky Flats said that “On , tax resisters made statements about their refusal to pay for war in a press conference outside the IRS office.”

The issue brought news of the Quaker war tax resisters Bruce & Ruth Graves’ court battle:

Quaker couple billed for tax not owed

A Quaker couple from Ypsilanti, Michigan, attempted to claim a “war tax” credit on federal income tax returns, but has lost an unusual case before the U.S. Supreme Court, the Associated Press reports. The court left intact lower court rulings that Bruce and Ruth Graves, as conscientious objectors, may not claim such a credit. The couple had sought a refund of the portion of their taxes used for war materials.

, the Graves have converted the “foreign tax credit” on their federal tax forms to a “war tax credit” and entered only 50 percent to the income tax otherwise due. Each year they have asked a refund but not received it. So after failing to get the couple to sign corrected tax statements, the government initiated action to collect the “deficiency” even though it had already collected the correct amount. The appeal argued that the government’ s action violated the Graves’ constitutional right to freedom of religion.

Catholic priest John M. Garvey also fought the law and the law won, a bit. The Gospel Herald had the scoop:

Priest who refused to pay taxes has to get around without a car

Father John M. Garvey gave up his car for Lent. Actually, the Internal Revenue Service hauled it away on Ash Wednesday. It now sits amid big, drab army trucks behind a fence topped with barbed wire 20 miles away in Mobridge, S.D. It is there because the Roman Catholic priest has not paid income taxes as a protest against military spending and the federal government’s treatment of Indian people.

Without a car on the South Dakota prairie, the priest has been walking more, hitchhiking, and riding buses. “It’s been inconvenient,” he said, and when he does he gets some puzzled looks. “But it’s no big dramatic thing. I’m not standing out there shivering to death.”

John K. Stoner, in the issue, imagined the conversation between a taxpayer and his or her Maker in the aftermath of a nuclear holocaust:

There was a blinding flash of light, an explosion like the bursting of a million bombs, and in an instant everything was burning in a huge ball of fire.

The first time it was the Flood.

But next time the fire… It was the End.

Afterward a prominent evangelical leader was being quizzed by his Maker.

“You say you were taken by surprise. But didn’t you know it might happen?”

“Well, yes, Sir. I guess I did, Sir. But You see, Sir, they…”

“Wasn’t anybody talking about the fantastic risks involved? But not risks really. It was a certainty. As predictable as death and taxes.”

“Well, Sir, I can see it now. But hindsight is always better…”

“What do you mean, hindsight? Couldn’t you discern the signs of the times?”

“Well, Sir, we were kind of busy…”

“Doing what?”

“Well, Sir, some of us were searching for remnants of Noah’s Ark. We thought if we found it maybe they would believe in You…”

“But surely you weren’t all hunting Noah’s Ark?”

“Well, Sir, not exactly. But a lot of people who weren’t hunting it were watching movies about the search. And then we were busy defending the Bible.”

“Why didn’t you know it was going to happen? Surely there were people warning you. In fact, I had assigned a few Myself to sound the alarm.”

“Well, Sir, You see, Sir, those people… I don’t know quite how to say this… er… they didn’t believe the way we… er… I mean I…”

“Did you think you could go on building three more bombs a day forever and not blow things up?

“Well, Sir, You see, I thought You would look after those things. I didn’t think it would happen unless You wanted.

“Women nursing infant babies? Children swinging on the side porch, playing in the lawn sprinkler? An old man reading his Bible? Millions of people, burned up?”

“Well, sir, in retrospect it does look rather overwhelming. I’m not sure it was really fair. But then, things were getting rather bad, what with communism, homosexuality, welfare, big government, pollution…”

“And capitalism, national security, the good life, nuclear deterrence.”

“Well, Sir, I hadn’t thought of those things as…”

“Why not?”

“Well, Sir, You see, the people who talked about those things were not… er… Bible believing. As an example, they talked about resisting war taxes, even though the Bible says, ‘Render unto Caesar…’. Things like that…”

“You paid your taxes?”

“Well, Sir, yes, Sir, I did.”

“Every penny?”

“I think so, Sir.”

“Are you saying that I am responsible for this fire and your tax dollars were not?”

“Well, Sir, I… er…”

“Next!”

Allan W. Smith responded in a letter to the editor, saying that Christians should beware of inadvertently putting themselves under an Antichrist who promises worldly peace at the expense of abandoning Biblical truth:

In Stoner’s depiction of the scene of judgment day, it is to be observed that Jesus dictum, “Render therefore unto Caesar the things which are Caesar’s,” is contradicted. It is not to be supposed that Jesus and Paul, who both told people to pay their taxes, were ignorant of the way that Rome got and held its power. Taxes are, after all, not freewill gifts to the state, and we may well be grieved with the way the state uses them. However, we must all live by our Word-enlightened consciences.

In , the General Board of the Mennonite Church met. Gospel Herald reported:

A proposed Mennonite Church statement on militarism and conscription, originally drafted by MBCM staff members Hubert Schwartzentruber and Gordon Zook in consultation with several other persons, was presented. The Board gave the statement extensive discussion and some refinement, and unanimously approved the document for submission as a recommendation from MBCM to the General Board for presentation to the Mennonite Church General Assembly. The statement contains sections on peace and obedience, use of material resources, Christian service and conscription, and militarism and taxation.

That article also noted that the Mennonite Board of Congregational Ministries met and approved a “task force to represent the Mennonite Church in cooperation with the General Conference Mennonite Church committee on conscientious objection and tax exemption.”

Hubert Schwartzentruber gave the keynote address at the Allegheny Conference annual meeting:

Sensing the radical nature of his comments on the theme, “The Way of Peace,” Schwartzentruber said that he could be taken to jail if he put into action his beliefs on such issues as war taxes and conscription. If he had to go to jail, he said, it would be easier to go with brothers and sisters in the faith. Peacemaking is the way of Jesus, but it has to be the work of the church and not of individuals alone, he said.

Representatives of the Mennonite Church gathered in Waterloo, , and war tax resistance was on the agenda but was overshadowed by other concerns about draft registration:

Debate over the proposed statement on militarism and conscription was centered in two subpoints. One counseled Mennonites not to comply with any military registration law that might be passed by the U.S. Congress if the Department of Defense and not civilians would be responsible for the registration program. The other point counseled administrators of church schools not to comply with any legislation which might be passed that would require them to provide information about their students for purposes of registration.

Noting that passage of any such registration bill is very much in doubt, Linden Wenger, Harrisonburg, Va., told fellow delegates, “It seems to me we’re being a bit premature in making an issue of these two items.” Wenger also said that he “will not hinge my decision” on whether to support compliance with a registration law on whether it is administered by civilian or military personnel.

Other delegates, including John E. Lapp of Souderton, Pa., responded that it was important that the items in question not be deleted.

In the amended statement which was finally approved, the two items were combined and weakened slightly, but were retained. A subpoint urging “careful biblical study” on the issue of war tax payment was added. In addition, the statement was upgraded from “guidelines” to a full statement of position.

The eventual statement on militarism and conscription that came out of the Waterloo conference on was reprinted in Gospel Herald. It included the following section:

On militarism and taxation

We recognize that today’s militarism expresses itself more and more through expensive and highly technical weaponry and that such equipment is dependent upon financial resources conscripted from citizens through taxation. Therefore,

- We encourage our members to pursue a lifestyle which minimizes such tax liability through reduction of taxable income and/or increase of tax deductible contributions for the advancement of the gospel and the relief of human suffering.

- We endorse efforts in support of legislation which would provide alternative uses for taxes, paid by conscientious objectors to war, which would otherwise be devoted to military purposes.

- We encourage our congregations to engage in careful biblical study regarding Christian responsibility to civil authorities including issues of conscience in relation to payment of taxes.

- We recognize as a valid witness the conscientious refusal to pay a portion of taxes required for war and military efforts. Such refusal, however, may not be pursued in a spirit of lawlessness nor for personal advantage but may be an occasion for constructive response to human need.

- We encourage our congregations and institutions to seek relief from the current legal requirement of collecting taxes through the withholding of income taxes of employees, especially those taxes which may be used for war purposes. In this effort we endorse cooperation with the General Conference Mennonite Church in the current search for judicial, legislative, and administrative alternatives to the collection of military-related taxes. In the meantime if congregational or institutional employers are led to noncompliance with the requirement to withhold such taxes, we pledge our support for those representatives of the church who may be called to account for such a witness.

On , Robert C. Johansen (“president of the Institute for World Order”) spoke at Goshen College and boosted war tax resistance:

Johansen encouraged his listeners to become part of a “new breed of abolitionists,” to take a more active stance, even if this included refusing to pay war taxes and refusing to be drafted. He reminded his audience that those in opposition to slavery had also defied the law in order to bring about change.

Gordon Zook, in the issue, wrote that the whole economy was distorted towards militarism, and took a sort of sideways look at tax resistance in that context:

One current issue of obedience is the militaristic mentality which keeps producing new weapons systems at the expense of basic human needs. So much of North American “abundance” results from the distorted values and priorities of our militaristic economy. Many are wondering, how to repent of such involvements including questions of responsibility for the use of tax revenues.

In the same issue, John K. Stoner was back to urge conscientious objection to nuclear deterrence which necessarily meant action before the nuclear war, not just options to be held in reserve for after the war started:

Mennonites who believe that the Bible teaches conscientious objection to military service should also be conscientious objectors to the concept and practice of nuclear deterrence. We have expressed conscientious objection to military service by refusing military service, whether by refusing to put on the military uniform, going to prison, doing alternate service, or emigrating. We should express our Conscientious objection to the concept and practice of nuclear deterrence by publicly rejecting the myth of nuclear deterrence, denouncing the idolatry of nuclear weapons, refusing to pay war taxes, and identifying with resistance to the nuclear madness.

Mennonites should do this because the concept and practice of nuclear deterrence is a form of military service in which the entire population has been conscripted. The concept of nuclear deterrence epitomizes the spirit of war. The practice of nuclear deterrence is to war what lust is to adultery, and whoever engages freely in lust should not consider himself innocent of adultery. As E.I. Watkin has said, it cannot “be morally right to threaten immoral conduct.” To plan and prepare for the annihilation of millions of people is a culpable act in the extreme, and whoever does not deliberately and explicitly repudiate the concept and practice of nuclear deterrence participates in the act.

The Catholic peace group Pax Christi wanted in on the war tax resistance action according to this report of their convention:

The U.S. branch of the international Roman Catholic peace movement, Pax Christi USA, initiated informal contacts with General Conference Mennonite peace spokespersons . Rural Benedictine College at Atchison, Kan., provided the setting for the sixth annual convention of Pax Christi USA, at which Mennonites Bob Hull and Don Kaufman of Newton, Kan., led a workshop on tax resistance and the World Peace Tax Fund Act. Interest in this was strong. About 40 persons, including some tax resisters, participated. In a private meeting with Sister Man Evelyn Jegen, executive secretary of Pax Christi USA, and Gordon Zahn, a Catholic conscientious objector in World War Ⅱ, Hull, Kaufman, and William Keeney of Bethel College, North Newton, Kan., explained the General Conference Mennonite Church resolution on war taxes. Mennonite Central Committee Peace Section’s Christian Peacemaker Registration form received active interest at the convention, particularly during a workshop on “Militarism in Education.” The possible resumption of registration and perhaps the draft in the U.S. is stimulating regional Pax Christi groups to promote conscientious objection to war by Catholic youth.

The issue noted that “MCC Peace Section (U.S.) is sponsoring a speakers bureau… to promote support of the World Peace Tax Fund among U.S. Mennonites and to be supportive of persons and groups who refuse to pay taxes used for military purposes.” The article included a list of speakers with their addresses and phone numbers, in case you’d like to track down some of the people involved back then.

When the MCC Peace Section (U.S.) met , war tax resistance was on the agenda:

Resolutions concerning the Iranian-U.S. crisis, SALT Ⅱ, and the proposed World Peace Tax Fund were passed at the fall meeting of Mennonite Central Committee Peace Section (U.S.), Nov. 30–Dec. 1 at Akron, Pa.

Section members also agreed to postpone a decision on a resolution to support war tax resistance campaign until they could have further dialogue with constituent members…

The World Peace Tax Fund (WPTF) bill now before Congress also received an endorsement from the Peace section group. The bill would provide a legal means for conscientious objectors to channel the portion of their tax dollar which now goes for the military budget to be used in a special fund for projects to promote world peace.

The section said in resolution “that it is conscious that the WPTF legislation might not in itself force a significant reduction in military spending, but it recognizes that it would provide funds for peacemaking efforts and would be a witness against military spending. The section continues to support other forms of witness against military spending, including persons who refuse to pay war taxes.”

Although Peace Section has given staff time to the promotion of a better understanding of WPTF in its constituency, it had not before been a formal sponsor of the bill.

Peace Section has also established a bureau of Christian speakers available to address congregations and other groups concerning WPTF.

On , a Mennonite war tax resister was convicted of tax evasion. I found it interesting that the prosecutor attacked Chrisman’s acts on scriptural grounds:

Federal court convicts Mennonite in Illinois war tax resistance case

Bruce Chrisman, 30-year-old General Conference Mennonite, was convicted on by U.S. District Court in Springfield, Ill., of federal income tax evasion.

Chrisman, who lives in Ava in southern Illinois, was charged with failing to file a tax return in . Actually Chrisman did file a return in and other years for which the government said he failed to file. But the returns did not contain the financial data the Internal Revenue Service contends constitutes a legal tax return.

Chrisman attached letters to his returns saying he objected on religious and moral grounds to paying taxes that support the U.S. military. His defense lawyers said the government had to prove that he “willfully” failed to file a return — that he knew what the statute required and purposefully decided not to comply.

At a three-day criminal trial Chrisman said, “The returns I filed with the IRS were in accordance with the dictates of my conscience and religious beliefs and the IRS code.”

He testified that his father never hit him and that “guns, even cap guns, were never allowed in our home.”

The prosecuting attorney read Romans 13, Luke 20:20–26, and Matthew 17:24–27 and asked Chrisman, “Don’t you believe in the Bible? Doesn’t it state here you should pay taxes?”

Chrisman said, “The government is not the supreme authority in my life, but Jesus Christ is.”

In the closing arguments to the jury the prosecution said Chrisman’s “joy” and “peaceful composure” exposed his lack of deeply held religious beliefs.

James Dunn, Mennonite pastor in Urbana, Ill., observed the trial. He said evidence of Chrisman’s character and of his pacifism were not allowed as testimony by the judge, J. Waldo Ackerman.

During the pretrial hearings, Ackerman allowed Robert Hull, secretary for peace and social concerns of the General Conference Mennonite Church, and Peter Ediger, director of Mennonite Voluntary Service, to testify about Mennonite witness against war and conscription of persons and money for war purposes. But the testimony was disallowed at the trial.

One of Chrisman’s attorneys, Jeffrey Weiss, in addressing the 12-member jury, argued that Chrisman’s religious beliefs and his conscientious objector status during the Vietnam War should exempt him from paying that portion of his federal income tax that supports the military. “He did not try to hide behind the shield of religion to rip off the government but honestly believes he is exercising his constitutional rights to religion.” he said.

Chrisman, married, with a two-year-old daughter, faces up to one year in prison and a $10,000 fine The verdict will be appealed to the U.S. Court of Appeals in Chicago.

A pair of articles advertised seminar on war tax resistance that would be held at Laurelville Mennonite Church Center in :

Does Caesar ask for only what belongs to him? Should there be a Mennonite consensus on paying or not paying war taxes? These and related questions will be the agenda for a seminar at Laurelville Church Center, . The seminar is entitled “War Taxes: to Pay or Not to Pay?” It is jointly sponsored by the Church Center and Mennonite Central Committee Peace Section. Persons on both sides of the issue are encouraged to participate. More information is available from Laurelville Mennonite Church Center…

“War Taxes: To Pay or Not to Pay?” is the title of a seminar cosponsored by MCC Peace Section and Laurelville Mennonite Church Center. Persons on all sides of the issue are encouraged to participate as such questions will be raised as: What belongs to Caesar and what to God? What are these taxes buying? What are the alternatives? More information is available from Laurelville Mennonite Church Center…

The GCMC Mid-Triennium

This was the first Gospel Herald report from the General Conference Mennonite Church special mid-triennium conference on war taxes:

Meeting shows diversity of views on militarism

Debate was vigorous and heated as more than 500 delegates from the General Conference Mennonite Church and some 200 visitors met to discuss how Christians should respond to the nuclear threat and to massive expenditures for defense. War tax resistance, or the refusal to pay for the military portion of the federal budget, was among possible responses discussed at the meeting, held in Minneapolis.

A few delegates present at the first day of the conference said the church should not act as tax collector for the state through withholding taxes from employees’ paychecks. But most of the delegates present the first day said that while they were troubled by worldwide military expenditures of over one billion dollars daily, the church as a corporate body should not engage in illegal activity in its witness against war preparations. Instead, speakers urged alternatives such as pressuring congressional representatives to reduce defense expenditures, eliminate the arms trade, and to increase aid and trade to Third World countries. A few observed that Mennonites contribute to the disparity in living standards around the world through their affluent lifestyle.

A sentiment often expressed, however, was that the church, while avoiding illegal actions, should actively support its members who engage in civil disobedience on the basis of conscience.

Roy Vogt, economics professor from Winnipeg, Manitoba, berated the assembly for loading the responsibility for witness upon isolated individuals. “It is morally reprehensible,” he said, “to give only moral support. We must provide financial and legal support for those prophets who have arisen from our middle-class ranks.”

In contrast to the social activists at the conference are Mennonites like Dan Dalke, pastor from Bluffton, Ohio, who castigated the social activists for making pacifism a religion. “We will never create a Utopia,” he said. “Jesus didn’t come to clean up social issues. Our job is to evangelize the world. A peace witness is secondary.”

Some of the statements were personal. A businessman confessed that while he could easily withhold paying military taxes on the basis of conscience, he was frightened. “I am scared of being different, of being embarrassed, of being alienated from my community. Unless I get support from the Mennonite church, I will keep paying taxes.”

Alvin Beachy of Newton, Kan., said the church seemed to be shifting from a quest to being faithful to the gospel to being legal before the government. Echoing this view, J.R. Burkholder of Goshen, Ind., said, “The question is not who is most faithful, but what does it mean to be faithful?”

A follow-up article in the issue filled in some blanks:

Church should not act as tax collector

General Conference Mennonites voted to launch a vigorous campaign to exempt the church from acting as a tax collector for the state.

Five-hundred delegates, representing 60,000 Mennonites in Canada and the U.S. passed the resolution by a nine to one margin. Charged with responsibility to implement the decision is the highest policy-making body of the General Conference Mennonite Church, the General Board.

Heinz Janzen, executive secretary for the denomination, said the decision will increase political activism among Mennonites, a group which has traditionally kept distant from legislative activities.

Delegates met in a special conference to discern the will of God for Christians in their response to militarism and the worldwide arms race.

Some Mennonites are practicing war tax resistance — the refusal to pay the military portion of federal income tax. This was a central focus of debate during because one of the employees of the General Conference has asked the church to stop withholding war taxes from her wages. In , Cornelia Lehn, who is director of children’s education, made the request on grounds of conscience. Her request was refused by the General Board because it would be illegal for an employer to not act as a tax collector for the Internal Revenue Service.

Although delegates to this convention affirmed that decision, they instructed the General Board to vigorously search for legal avenues to exempt the church from collecting taxes. In that way individuals employed by the church would be free to follow their own conscience.

The campaign to obtain legal conscientious objection to war taxes will last three years. If fruitless the question is to be brought back to another meeting of the church.

Activists in the church were not completely satisfied with the decision. They would prefer that Cornelia Lehn’s request be granted. These delegates spoke for an early First Amendment test of the constitutionality of the church being compelled to act as a tax collector.

Nevertheless, Donovan Smucker, vice-president of the General Conference and from Kitchener, Ont., said of the decision, “Something wonderful is happening. We are beginning to bring our witness to the political order.”

Vernon Lohrenz, a delegate from South Dakota, observed, “We must proceed in faith, and not in fear. If this is the right thing to do, God will take care of us.”

From the discussions on taxation, it seemed the issue will not easily be resolved.

The issue gave an update on how the General Conference Mennonite Church was progressing on the goals it had set for itself:

Slow progress reported by task force on taxes

Implementing the decision of the General Conference Mennonite Church “war tax” conference in Minneapolis has not been easy.

The Minneapolis resolution mandated a task force on taxes to seek “all legal, legislative, and administrative avenues for achieving a conscientious objector exemption” for the General Conference Mennonite Church from the withholding of federal income taxes from its employees. (About 46 percent of U.S. federal taxes are used for the military.)

Two meetings of the task force have been held. The task force has been expanded to include representation from the Church of the Brethren, the Friends, and the Mennonite Church. This group of 11 is expected by the participating churches to establish the legal, legislative, and administrative agenda of a corporate discipleship response to military taxes.

At their second meeting () the task force members rejected administrative avenues. Within the scope of U.S. Internal Revenue Service or Revenue Canada regulations, this would involve extending ordination, commissioning, or licensing status to all employees of church institutions. It was a consensus of the task force that this would be an administrative loophole. It would not develop a conscientious objector position in response to military taxes.

However, both the judicial and legislative options will be pursued simultaneously. Plans for the legislative option are the more developed.

For the legislative route to work, says Delton Franz, director of the Mennonite Central Committee Peace Section office in Washington, D.C., the problem of conscience and taxes will have to be defined carefully. Currently a paper focusing on the reasons the General Conference has a major problem of conscience with collecting taxes from its employees is being drafted. After it has been reviewed, it will be sent along with cover letters by leaders of the historic peace churches to members of Congress who represent major constituency concentrations or sit on key subcommittees. Later on, church members will also be asked to write letters. It is important, says Franz, to define the problem of conscience in such a way that it will motivate Senators and Representatives to work vigorously for the bill.

Another follow-up to these initiatives will be a visit to Washington of the most influential peace church leaders to solicit support from selected members of Congress and to obtain a sponsor for an exemption bill.

There is a possibility that a parallel task force will emerge in Canada. Ernie Regehr, director of Project Ploughshares, Waterloo, Ont., notes the necessity of defining the question of militarism in Canadian terms for Canadians; for example, arms export revenues. Regehr in attempting to gather a Canadian task force. Heinz Janzen, general secretary of the General Conference Mennonite Church, is convener of the war tax expanded task force. Mennonite Church members are Winifred Beechy, secretary for peace and social concerns under the Board of Congregational Ministries; Janet Reedy, member of the Mennonite Church committee on tax concerns; and Gordon Zook, executive secretary of the Board of Congregational Ministries.

A New Call to Peacemaking

The “New Call to Peacemaking” campaign continued. Another conference was announced for :

workshops will deal with conflict resolution, tax resistance and the World Peace Tax Fund, economic conversion and the arms race, and resources for peace education.

Organizers of the Peace Tax Fund legislation campaign took heart:

Campaign organizers assert that interest in the “issue of conscience and war taxes” has been growing recently. It was given a “high priority” by the New Call to Peacemaking national conference in Wisconsin.

Results of the conference (which had apparently been pushed back a few weeks) were reported by Winifred N. Beechy:

More war-tax opposition

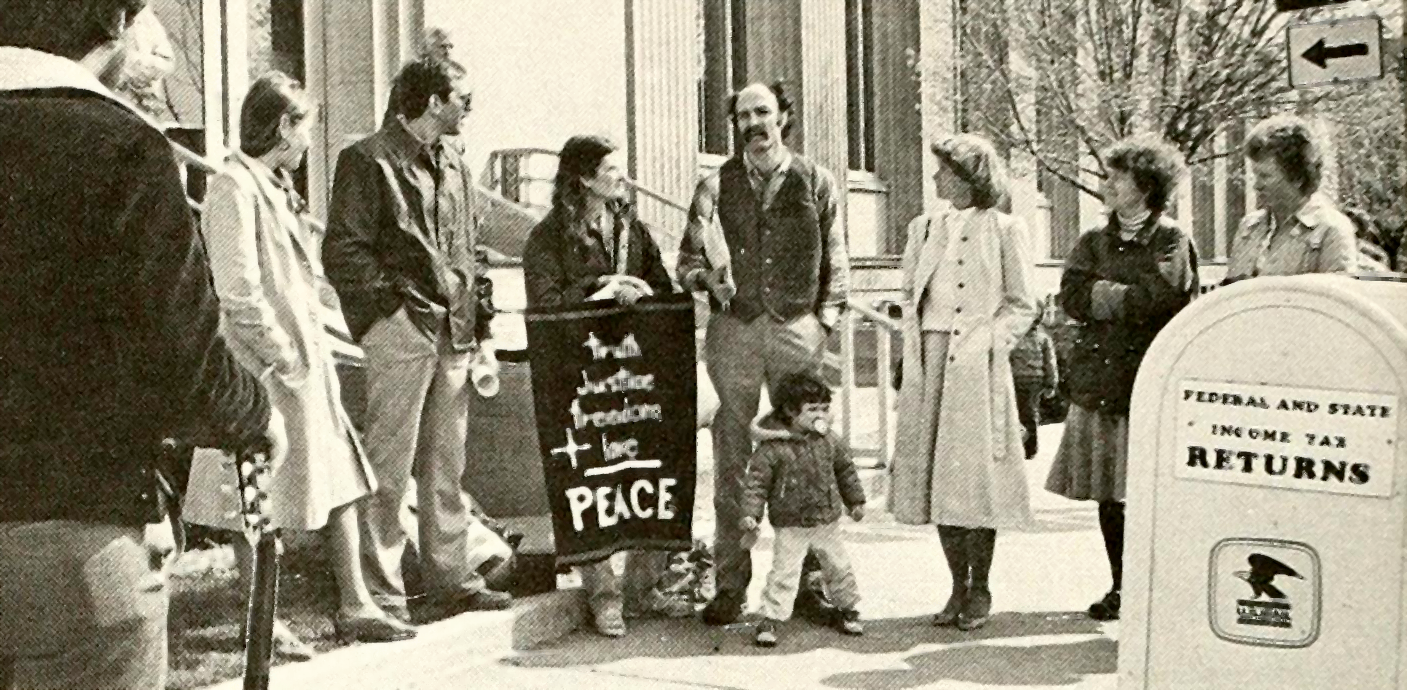

A group of 30 to 40 church people met on , at City Church of the Brethren, Goshen, Ind., to consider the moral dilemma faced by Christians who are opposed to war as a method of settling disputes but who involuntarily contribute to war by payment of taxes.

Participants in the one-day seminar came from 12 area congregations and represented four denominations. The focus of the meeting was on that portion of the federal income tax which goes to support the military and weapons production. This group felt that the increasing militarization of our society, the escalation of the arms race, and production of highly technological weapons of destruction posed the problem of priorities and stewardship, and the contradiction of “paying for war while praying for peace.”

Willard Swartley, professor of New Testament at Associated Mennonite Biblical Seminaries in Elkhart, spoke on “Biblical imperatives,” emphasizing the Christian’s mandate for responsible use of the earth’s resources. Cliff Kindy of Goshen then outlined what we pay for war, giving a breakdown of the federal budget with percentages of expenditures going to current and past military and war-related items. He computed current military spending as roughly 25 to 30 percent, while a more comprehensive figure, taking into account veterans’ expenses and interest on the war-related portion of the national debt, reaches as high as 50 percent of the national budget. Kindy also estimated that members of Mennonite and Church of the Brethren churches in Elkhart County pay more for war taxes than they contribute to their churches.

A survey of the history of war tax resistance among the historic peace churches since the Reformation was presented by Leonard Gross, archivist of the Mennonite Church. Current responses to the problem of war taxes were given by a number of people. Janet Reedy of Elkhart and Jim Sweigart of Goshen discussed possible options such as refusal to pay that portion of the income tax which goes to support war, payment made with an accompanying letter or protest, or voluntarily limiting income below the level of tax liability.

Following the presentations the group broke up into three workshops for further discussion. From these emerged a consensus on the need for a continuing support group such as this. Participants expect to draft a statement which can be presented to their respective congregations for consideration.

The seminar was planned by a New Call to Peacemaking Committee made up of members from six Church of the Brethren and Mennonite Churches in Goshen, with Virgil Brenneman from The Assembly (Mennonite) serving as chairman.

And the “4th Mid-America New Call to Peacemaking” was held in . The theme was “Conscription of Youth and Wealth”:

The workshop on national service and voluntary service discussed a proposal by members of Rainbow Boulevard Mennonite Church, Kansas City, Kan., regarding a legal tax alternative which would involve cooperating with a national service plan.

In the workshop on conscription of wealth Bob Hull, secretary for peace and social concerns of the General Conference Mennonite Church, suggested alternatives to paying war taxes. Others offered their own suggestions.

Several persons expressed the desire to pay taxes only for nonmilitary programs, and said they wished there was legal provision for this, such as the World Peace Tax Fund. McSorley, who has had contacts on Capitol Hill, responded by saying that until there is a large grass-roots movement of tax resistance the WPTF doesn’t stand a chance.

The latter half of the workshop included sharing by Bruce Chrisman, Carbondale, Ill., who is involved in a federal criminal case, one of two in the U.S. involving tax resistance. His case is significant because it will provide a precedent either for or against tax refusal on the basis of conscience and religious convictions.

In Chrisman received draft counseling from James Dunn, pastor of the Champaign-Urbana (Ill.) Mennonite Church. He made a covenant with God to only pay taxes for humanitarian purposes. Since that time he has paid no federal income taxes.

It wasn’t until this year, however, that the government prosecuted him, charging that he willfully failed to disclose his gross income in . “Willful” is the key term, because Chrisman claims he conscientiously chose not to disclose his income. He feels the government has purposely waited to build its case.

In the conclusion to his talk Chrisman said that when he first appeared in court on this year he was “scared to death.” “Today,” he said, “I have no fear in me. God has given me an inner peace. I know I’m doing what He wants me to do.”

The Smoketown Consultation

The Gospel Herald covered “the Smoketown Consultation” of , in which conservative Mennonites organized against innovations like war tax resistance. It noted that “All 25 persons invited were white males,” but also reproduced the statement that came out of the conference.

Several letters to the editor reacted to this news:

- Harvey Yoder

- “I… wondered about the inclusion of the specific war tax issue. Were individuals who sincerely hold to an alternate point of view asked to take part in the discussion? Again, I am not questioning the conclusions of the group so much as to ask whether any ‘by-invitation-only’ meeting can speak for the church with any more integrity than can existing boards and commissions of the church.”

- John E. Lapp

- Also wondered why the Smoketown crew picked out the war tax issue in particular.

- Jim Drescher

- “It is very easy to pick a Scripture verse to use to prove or disprove almost anything. The group at one point (Statement #2) speaks about total commitment to Jesus Christ but then uses quotations from the Apostle Paul (Statement #5) to validify payment of all taxes. If Jesus Christ is central, let’s use His example and specific words to guide us! I can imagine the Pentagon people jumping for joy upon hearing such a statement about taxes. I’m sure they are glad for this voluntary assurance (from ‘peace church’ members) that money will continue to roll in so that the military can increase its nuclear arsenal. Because of the apparent unquestioning payment of taxes by German Christians, Hitler was able to annihilate millions of persons. We (U.S.) will be able to do it with nuclear weapons Neat, eh?”

- Greg & Ellen Bownan

- “At Smoketown Ⅱ, when we assume the sisters of the church will take the opportunity to share their thoughts, we suggest that a fuller range of statements be reported. Issues, the unavoidable places where doctrine meets practical decisions, should be identified and addressed to give definition to the positive reaffirmation of the authority of Scripture and a renewed zeal for personal and church evangelism. And, for the grass roots, a minority report on the nonpayment of war taxes could be included.”

- John Verburg

- Verburg didn’t think much of all this talk about war taxes, saying that the peace witness was about more than opposition to military, so the war tax emphasis was sign of an imbalance. “We are not the flower children of the sixties. We are Jesus people and there is a big difference.”

When the General Board of the Mennonite Church met in , the Smoketown consultation came up.:

[Gordon] Zook [executive secretary of the Board of Congregational Ministries] noted the difference between the Smoketown statement “that we should pay all taxes” and the statement on peacemaking passed by the General Assembly at Waterloo. The Waterloo statement recognizes the withholding of war taxes as a valid option. Which statement represents the church? he asked.

Peace Tax Fund Legislation

The edition included an article by Dan Slabaugh laying out the case for the World Peace Tax Fund bill. An editor’s note in that issue mentioned that “The U.S. copies of the issue of the Gospel Herald carried a center insert with cards that may be used by readers to encourage U.S. lawmakers to support the World Peace Tax Fund. The following article provides the author’s rationale for support of the Fund legislation. Readers who care to are encouraged to make use of these cards or to write their own leaders on its behalf.”

Why I support the World Peace Tax Fund

by Dan Slabaugh

Any collection of taxes for military purposes has created problems of conscience for those committed to the peaceful resolution of conflict. Many members of the “historic peace churches” have viewed war taxes as a denial of religious freedom since such payments forced them to engage in personal sin. The question has been put this way: “How can I, as a follower of the Prince of Peace, willingly provide the government with money that’s needed to pay for war?”

The most recent war tax in the United States, aside from the income tax, has been the federal telephone tax. This levy was initiated originally to support the Vietnam War, but is still continuing for a few more years. Many people have refused to pay this tax to the federal government. Instead, they have been sending the equivalent amount to the [“]Special Fund for Tax Resisters” of Mennonite Central Committee’s Peace Section, or to similar designated organizations.

To a smaller percentage of individuals the payment of the federal income tax (approximately 50 percent of which they know goes to support wars and military activity) also has been considered a matter of personal sin. They therefore have informed the government that in good conscience they cannot voluntarily pay that portion of their tax. In some cases persons have deposited the amount in a local bank where the Internal Revenue Service comes and “steals” it from them. By so doing these persons are freeing themselves of personal responsibility for the money’s eventual use and also providing a visible protest against the evil.

To most of these law-abiding, peace-loving people continual confrontation with their own government has been an unhappy prospect. So nearly a decade ago a small group of Christians at Ann Arbor, Michigan — with considerable faith in the American legislative process — came to believe that it might be possible to draft a bill and eventually convince the federal government to legalize “peace” for those citizens so inclined.

A faculty member and a few graduate students at the University of Michigan’s Law School drafted such a proposal. It provides, for the individual requesting it, a setting aside of that percentage of the federal income tax which the U.S. Attorney General would determine to be earmarked for military purposes. This amount would then be placed in a trust fund to be administered by a board of trustees to fund peaceful activities, as approved by the U.S. Congress.

This legislation, which has become known as the World Peace Tax Fund bill, was introduced into the U.S. House of Representatives by Ronald Dellums of California in . In the National Council for a WPTF was invited to present its case in the House Ways and Means Committee. The bill was introduced into the Senate in by Senator Mark O. Hatfield of Oregon. In the last Congress it had 25 sponsors in the House of Representatives and the three in the Senate (The legislation was not enacted and so must be reintroduced to be considered by the present Congress.)

The World Peace Tax Fund bill is often misunderstood. It does not call for any tax relief or special favors benefiting anyone financially. The bill, if passed, probably will not affect the U.S. government’s military activities. In all likelihood it will not cut the military budget, or of itself, stop wars. And it will not diminish the need to continue peace teaching or peace activities.

But it will allow a citizen to legally refrain from contributing to the cost of war and violence. It will provide a fund to finance peace programs and support efforts to eliminate the causes of violent conflict.

The biggest obstacle to getting this bill passed in the U.S. Congress is the large number of people who say they are committed to peace, but who seemingly feel no responsibility regarding the government’s use of their tax money. As a result, legislators tell us that they can’t see the payment of war taxes as much of a problem because they get very few letters expressing concern about the matter.

To a large degree, Congress is “problem-oriented.” An alert young Congressman told us personally that “this bill probably will not be passed until enough of you refuse to pay war taxes — even if it means going to jail. In other words,” he was saying, “create a problem that Congress must deal with.”

I am convinced that the conscientious objector provision of the Selective Service act of never would have been included had it not been for the “problem” created by C.O.’s who refused induction during World War Ⅰ. As the U.S. was mobilizing for World War Ⅱ the government did not want another “problem” on its hands, so it agreed to make provisions for the C.O.’s — not necessarily out of concern for religious liberty, but in order to keep the boat from rocking too much.

We should remember that God’s prophets and even His own Son were seen as “problems” in terms of natural human tendencies toward power, selfishness and greed. Few of us like to “cause problems” for others. We like to work at solving them — and be successful in our efforts. But in matters of conscience, we haven’t been called to be successful, we have been called to be faithful.

“Conscience and War Taxes” is the title of a slide set produced by the National Council for a World Peace Tax Fund. A resources packet accompanies the 78 color slides, 20-minute cassette. “Conscience and War Taxes” can be obtained from MBCM Audiovisuals…

Lobbying didn’t always go so smoothly, as this report from a Mennonite study group at East Union Mennonite Church () shows:

The first issue the class tackled was the payment of war taxes. In U.S. Rep. Edward Mezvinsky was invited to church for Sunday lunch and a discussion of the war tax issue.

“He sidestepped every issue,” said Jim Yoder. Mezvinsky promised to vote for the World Peace Tax Fund Act if it ever made it to the floor of the House, but declined to help the bill out of committee.

“He spent most of his time expounding upon his efforts to kill the B-1 bomber,” recalled Nyle.

When the Fourth of July rolled around that Bicentennial year, the class sponsored an alternate celebration for the church. Guy Hershberger was asked to chair the meeting. He interviewed some of the local “veterans” — conscientious objectors Henry Miller, Henry Brenneman, and Sol Ropp — who had been badly mistreated by the U.S. Army during World War Ⅱ. He also discussed the war tax issue.

Later in the year the class presented a proposal to the congregation, asking the church to lend moral support to people who did not pay the portion of their taxes going for war. After initial misunderstandings and further discussion, the congregation approved the proposal.

Nyle [Kauffman] and Jim were the only class members making enough to have to worry about paying any taxes at all in . Both withheld 33 percent of their estimated tax and sent a check for the amount to Mennonite Central Committee.