Hold Resisters’ Property in Others’ Names

A common government gambit in its battle against tax resisters is to say “if you won’t pay taxes ‘voluntarily,’ we’ll seize your property instead.”

Some tax resisters respond by taunting back: “you’ll have to find it first.” One way they make good on this is by arranging for other people to hold the resisters’ property in their names.

For example, some war tax resistance “alternative funds” or “peace funds,” into which resisters pay their taxes rather than submitting them to the government, have a dual purpose: they redirect tax money to causes the resisters find more palatable than military expenses, and they form a fund that, although it is not officially in their names, resisters can later informally reclaim if the government succeeds in seizing taxes from them.

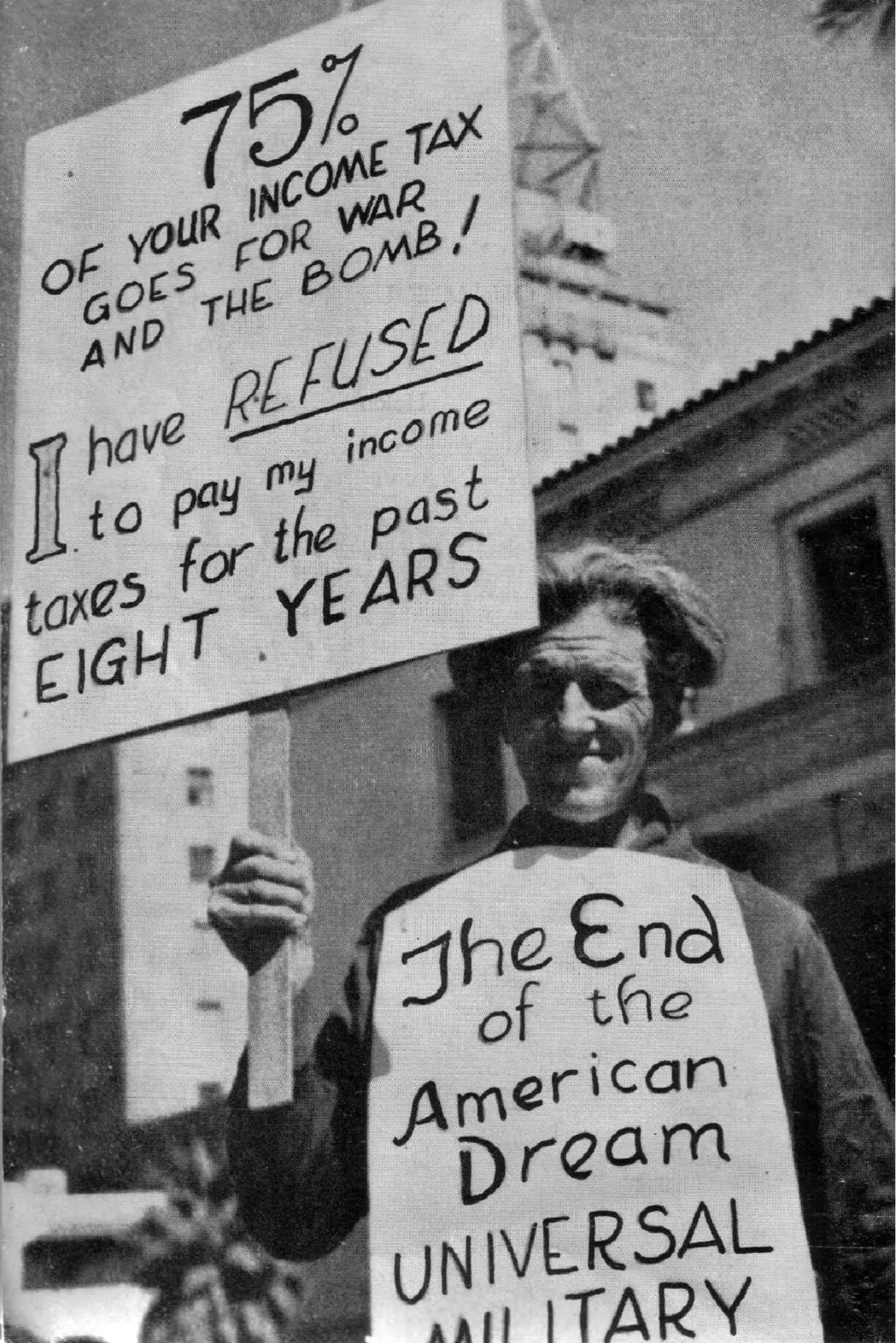

Example Ammon Hennacy

Section titled “ Ammon Hennacy”The tax collector was so frustrated trying to seize anything from tax resister Ammon Hennacy that, when Hennacy was picketing the Internal Revenue Service (IRS) office one day, the agent assigned to his case walked up to him and seized his picket sign—telling him he planned to auction it off for back taxes!

The next day, though, Hennacy was picketing again with some new signs that he and a friend had hastily made the night before… each one carefully labeled “this sign is the personal property of Joseph Craigmyle.”

Example The Tithe War

Section titled “ The Tithe War”During the Irish Tithe War, sympathetic farmers would give temporary pasturage to the livestock of resisters when seizures were impending:

An organised system of confederacy, whereby signals were, for miles around, recognised and answered, started into latent vitality. True Irish “winks” were exchanged; and when the rector, at the head of a detachment of police, military, bailiffs, clerks, and auctioneers, would make his descent on the lands of the peasantry, he found the cattle removed, and one or two grinning countenances occupying their place. A search was, of course, instituted, and often days were consumed in prosecuting it.

Example American Quakers

Section titled “ American Quakers”In 1983 the Friends General Conference put an ad in the Friends Journal that encouraged Quakers to give interest-free loans to the Conference. This, the ad said, was a way Quakers could “reduce their income taxes while retaining financial security for themselves and their families.” The Conference would collect any interest on the funds as a donation, and in return it would hold the donor’s assets in a way that was non-reportable to the IRS, while being willing to return the principal to the donor on 30-days’ notice.

Example Poll Tax Rebellion

Section titled “ Poll Tax Rebellion”This tactic was used to resist warrant sales during the Poll Tax rebellion. A resistance newsletter noted:

The Debtors (Scotland) Act 1987 has so limited the nature of goods which can be poinded and sold, that anything which is saleable can easily be “farmed out” to a friend or neighbour until after the sheriff officers have called.

Legal advisors also encouraged more enduring techniques:

People were… told how to avoid bailiff action by signing away their possessions to people who lived outside of the area or, preferably, to their children. There are now young children who technically own all of their parents’ possessions.

Notes and Citations

- Ortman, David E. “How to start a peace fund” The Mennonite 14 March 1989, p. 104

- Hennacy, Ammon “My First Fast and Picketing” We Won’t Pay: A Tax Resistance Reader (2008) p. 385

- Fitzpatrick, William John The Life, Times, and Correspondence of the Right Rev. Dr. Doyle, Vol. II (1862) p. 408

- “Give Money Without Giving Your Money Away” (ad) Friends Journal 15 March 1983, p. 21

- “Warrant sales and how we can win the fight against the poll tax” Refuse and Resist #2, January–February 1990, p. 4

- Burns, Danny Poll Tax Rebellion (AK Press, 1992), pp. 136, 151