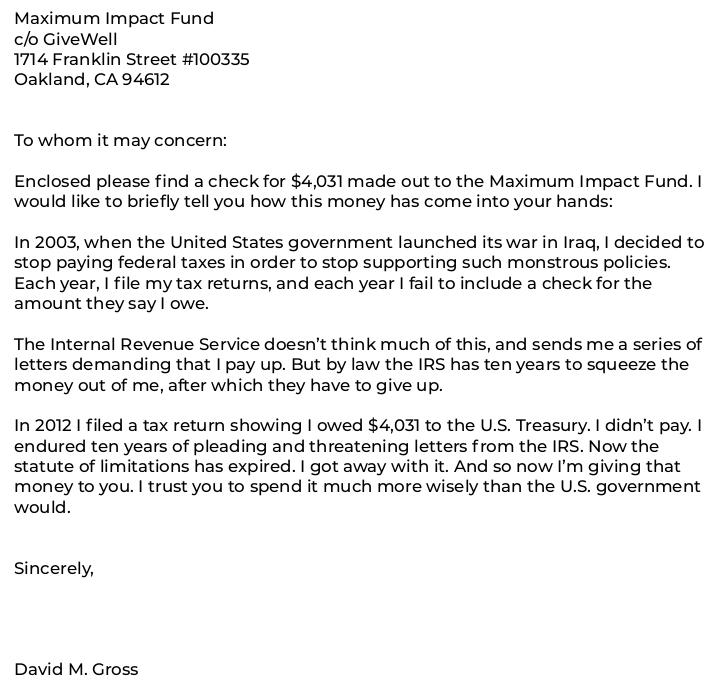

Today I’m sending a check for $4,031 — representing what I didn’t pay in federal taxes in — to the Maximum Impact Fund run by the GiveWell organization.

GiveWell researches promising charities to determine which are currently able to make the greatest impact per donated dollar. They have a number of top recommendations, mostly involving disease prevention in poorer parts of the world. Rather than choose from those, I chose the simpler option, which is to give to GiveWell’s Maximum Impact Fund, whereupon GiveWill will give that money to whichever charity is currently at the top of their list.

You may remember that I also redirected my taxes to the Maximum Impact Fund .