War tax resistance in the Friends Journal in

By , though there was still no consensus in the Society of Friends about whether paying taxes was the right thing to do (and if not, how best to resist it), the issue had become impossible to avoid. The issues of the Friends Journal published that year reflect this, with most of them including at least a mention of war tax resistance or of the dilemma for Quaker taxpayers.

War tax resistance was again on the agenda of the Philadelphia Yearly Meeting’s annual conference , but the Journal only includes the topic in a list of “special concerns” that were covered on , without giving any details of how the conversation went.

In the opening article in the issue, “Tithing for Peace” by Alan Strain, the author expresses his anguish over how much he has “tithed for war and instruments of war… several dollars each day to create a warfare state in which fear and violence have become ever more accepted and expected.” However: “I cannot see how to disentangle myself from this madness… I cannot even see a way to end my involuntary tithing for war.” Rather than resist the war tithe, he has decided to try to match it with a peace tithe: “giving this amount to private or public agencies working to remove the causes of war and to develop the conditions and institutions of peace.”

In that same issue, a note about the Canadian Friends Service Committee’s humanitarian efforts in Vietnam includes a parenthetical remark that some of the $60,000 donated to the cause came from “two U.S. churchmen who sent money normally used to pay income taxes.”

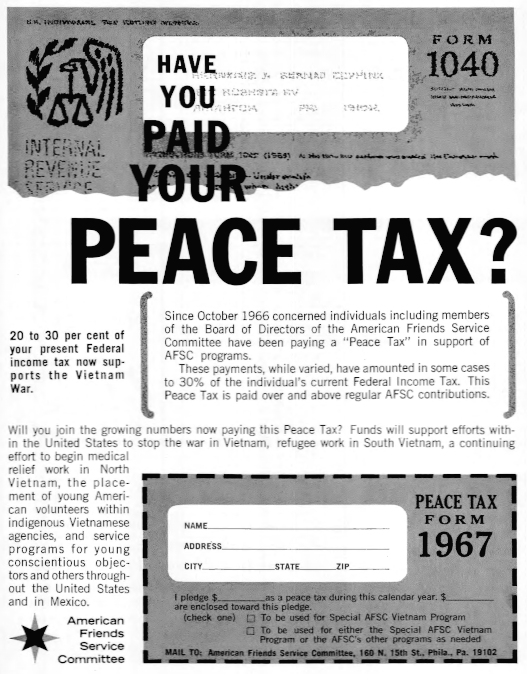

In the issue, the American Friends Service Committee tried to capitalize on the new craze with this ad:

In the Baltimore Yearly Meetings approved a minute “including refusal to pay the surtax for the war if such a tax is imposed.”

An article by Cynthia E. Kerman on “The Rationale of Protest” in the issue made note in passing of the communicative possibilities of war tax resistance: “Tax refusal, for instance, may be a means of speaking to people — not only of purifying our lives.”

In the issue, a letter from Lucy P. Carner picked up where Cynthia E. Kerman left off, asserting that there are “possibilities for witness inherent in tax refusal” that are not immediately obvious to people who are looking for a quick fix “to put a stop to war.” Excerpts:

Tax refusal enables one to “speak truth to power.” A letter to the Revenue Service protesting the tax, but paying it, is likely to get less attention than one explaining why one is not paying a portion of the tax. In the latter case, the Revenue Service has to do something about it. A representative of the service has to make a telephone call reminding the taxpayer of his delinquency. Here is another opportunity to witness.

“You mean you do not intend to pay?” said the incredulous voice of the representative. I explained to him what I had already written to his office. “Yes, I know that you will eventually get the money from my bank. That isn’t your fault and you have very courteously fulfilled your duty. But this is my way of saying that I think the war is wrong. Only for that reason would I break the law — I’m not accustomed to breaking laws.”

“Yes,” said he, rather helplessly, and hung up.

A few months later a bank official will send a letter saying how much the bank would regret allowing the tax collector to take money from my account and won’t I please pay up and avoid this embarrassment. Here is another opportunity to write my objection to the war. Refusal to pay the additional Federal tax on my telephone bill provides similar opportunity to make my voice heard.

Tax refusal, then, is a manner of speaking to government officials, to banks and business concerns. It is a nonviolent way of reaching the hard-to-reach, for it has nuisance value. It deserves wide consideration as one way of bearing witness to one’s conscientious objection to war.

The lead editorial in that same issue, by Ruth A. Miner, suggests that instead of resisting war taxes, Quakers should pay an additional tax — “the same amount (or a practicable fraction of it — or even more!)” — to the United Nations. This, she suggests, would be in the spirit of Jesus’s suggestion that “whoever compels you to go one mile, go with him two.”

That issue was also the first to feature the ad from “Southern California Business Service” (see ♇ 1 July 2013) that included the message: “A word about tax refusal: Since we limit our income to avoid paying income tax, our rates are low — and — in hiring our help we actively seek out C.O.s and/or tax refusers.”

Phone tax resistance

James B. Osgood, in a letter-to-the-editor in the issue, takes note of the American Friends Service Committee’s “stickers which one can attach to one’s phone bill to make payment of the war tax under protest” (see ♇ 13 July 2013).

This form of protest is better than nothing, but its practical effect is next to nothing. No real witness is made; no war funds are withheld from the government; no one’s reputation is put on the line.

Those of us who have refused to pay the ten per cent tax hope that others joining us will make a great visible witness and will cause sufficient trouble to the government to give it pause for thought over both collection and prosecution of those who conscientiously refuse. This, however, will require a real step forward, not a mere licking of a label.

Maris Cakars of the Committee for Nonviolent Action also wrote in, and his letter appeared in the following issue. He believed that there were “hundreds” of telephone tax resisters who had not notified the Committee of their resistance, and hoped they would speak up so that the campaign could move on to its next phase: “placing advertisement in newspapers and holding press conferences. For this phase to have maximum impact it is important for us to have as complete a list of tax refusers as possible.”

The issue announced that the Claremont (California) Meeting had decided to resist the telephone tax on its meetinghouse phone.

In the issue was a letter from a representative of 57th Street Meeting in Chicago, in which they noted that two other Meetings had contacted them about actions they had taken in response to their call for phone tax resistance, and said “we would be pleased to act as a clearinghouse on positions taken by Meetings on telephone-tax refusal…”

In the issue, George Lakey wrote an article about why he was joining the crew of the Phoenix to illegally (by U.S. law) bring humanitarian aid to North Vietnam. He described the escalation of his activism, from letter-writing and congressman-lobbying to his current action. Along the way, he says, “I stopped paying the telephone tax.”

War tax resistance internationally

The issue noted that Quakers in The Netherlands had formed a “Conscientious Objectors’ Committee Against Paying Taxes for Defense Purposes” which was trying to come up with some sort of government-approved “peace tax”-style plan. I got a wry smile out of the closing sentence: “In The Netherlands it is not permitted to affix protest stickers on tax forms; instead one must use a written announcement of protest.”

The fourth Friends World Conference was held . The “Protest and Direct Action group” there “called upon Friends in countries party to the [Vietnam] conflict to ‘go as far as conscience dictates in withholding support from their governments’ war-making machinery,’ first by direct communication with those against whom the protest is made, and then if necessary by public witness and individual action, including the possibility of refusal to pay taxes for war.”

“Corporate Witness and Individual Conscience”

The lead (guest) editorial in the issue was “Corporate Witness and Individual Conscience” by Lindsley H. Noble. It cautioned Quaker corporate bodies (like Meetings) that were contemplating civil disobedience actions like phone tax resistance. For one thing, he says, a Quaker group should make sure to have the consent of all of its members before it takes such a drastic step, something he thinks some groups have been careless about. Secondly, even if every member of the group consents to civil disobedience, the group as a corporation has a different relationship to the state than individuals do. While individuals and their consciences predate and arguably supersede the state, corporations are creatures of the state and are therefore necessarily subordinate to them. Quakers incorporate their meetings in part in order to get government privileges associated with legal incorporation. “In voluntarily putting ourselves under the law to receive these subsidies do we not morally forego corporately the right to refuse to obey other laws not to our liking?” If Quakers, as a group, find a law so intolerable that they must disobey it as a group, he says, they should first legally detach themselves — “withdraw from our contract with the state and give up our subsidies before setting out on this path.”

This led to months of discussion in the letters-to-the-editor sections of future issues, in particular:

- Victor Paschkis thought that Noble’s argument failed on both points. First, his call for groups to reach consensus before taking a civilly disobedient stand should be understood for what it is — merely a preference for the law-abiding status quo. After all, “inaction in a given situation may violate the conscience of some members just as action may violate the conscience of others.” Secondly, a Quaker Meeting, whether or not it has incorporated under the laws of the state, still has a yet higher allegiance to God that must be taken into account. Also, what’s the point of having Meetings if they do not have “corporate insight” greater than the sum of their parts?

- Stephen G. Cary mirrored some of this: “There are times when inaction speaks to the world as clearly as action. In these situations inaction does not leave us neutral, but committed by default. Responsibility is not a one-way street, resting only on Friends who wish an action taken. Those who oppose the action are committing the Meeting, too. I do not suggest that the proponents’ views should necessarily prevail; I only want it recognized that responsibility to conscience cuts both ways and requires both sides to search their hearts.” He is also suspect of the idea that corporate entities have no responsibility to disobey unjust laws: “Does the Nuremburg principle have no bearing on the institutions of society? I prefer to regard the corporation as the creature of those who create and operate it, and the fact that the state charters it does not make the state its ultimate master.”

- Marie S. Klooz also defended “corporate witness” as being not exactly “the witness of a corporation” but the collective witness of the corporation’s “component members.” Such a thing is not only justifiable, but is particularly important to Quakers: “Each member is supposed to test his light by the corporate light.” And: “If the light requires social action, it is our duty to labor lovingly with those whose light differs, not to refrain from action.” It is no more necessary for a Meeting to divest itself of its corporate charter to be civilly disobedient, than it is necessary for an individual to first renounce his citizenship.

- Pat Foreman found himself uncomfortable with the peace testimony “as interpreted by most Friends” and thinks Quakers like him “sometimes have the feeling that we are being shunned.” He wants “to remind Friends that Quakerism is a religion and not a prodigious committee.”

- Evan Howe thought that dissenters were asking too much if they were asking Quaker Meetings to give up their corporate privileges in order to engage in civilly disobedient actions under the direction of the “sense of the Meeting.” Such a “surrender of subsidies, as I see it, while apparently a demand of conscience, is rather a surrender of conscience with the ultimate consequence of destroying the society. I do not believe that dissent gives anyone that right.”

- Norman J. Whitney stressed that “Meetings do have a responsibility for corporate witness if the integrity of our testimonies is to be maintained. It is not enough to shift responsibility to ad hoc committees or special groups among us.”

- Roy W. Moger suggested that Noble had hit on a truth when he suggested

that legal incorporation was a sort of “trap” that the Religious Society

of Friends had fallen into, “thereby placing our conscience in jeopardy.”:

I wonder if the Religious Society of Friends should not begin to unincorporate and remove itself from the trap into which it has fallen, so that Friends can once more seek dependence upon the Holy Spirit, act under guidance of that Spirit as a corporate body, and not have to say, “As a group we dare not take corporate action [and offend the state] because our corporate life depends upon the State, and we are obligated to obey. The individual can alone take the risk and break the law of the State if he feels the law of the State breaks the law of God.”

- Roger S. Lorenz said that because there is a good argument that the Vietnam war is itself illegal, both under international and under domestic law, what it means for a person (or a corporation) to remain within the law under our circumstances is no easy question to answer.

David Hartsough

Over the years, starting in , David Hartsough contributed several pieces to the Friends Journal touching on war tax resistance:

- In the issue, he set out a simple, compelling case for war tax resistance — “is it not our responsibility to set the example and refuse to pay our taxes for the weapons and ammunition which inflict this suffering?” He also suggested that if enough people were to refuse, the government would probably legalize some form of conscientious objection to military taxation.

- In the issue, he paraphrased George Fox’s advice to William Penn: “Pay the military portion of thy tax as long as thou canst.” He suggested that people begin now by resisting the phone tax, and then prepare to resist “the 69.2 percent of our income taxes which go for war” .

- In the issue, he told the story of what happened when an IRS agent came to his office to try to collect his unpaid income taxes.

Excerpts:

We talked about the Nürnburg trials, in which the Americans told the Germans that they should obey their consciences rather than their state. I told him I felt that when we are bombing and burning people and their homes in Vietnam, I cannot condone this action by paying other people to do it.

“I want to make it clear that I have no argument with you on your position about the war,” he said. “I do not argue that you shouldn’t follow your conscience. But it is my responsibility to get this money.”

…he gave me a financial statement to fill out. I refused. He reminded me: “It’s my job to get this money in any way I can. I don’t like to do this, but we can take any property you have — your house, your car, or whatever.”

“I have a bicycle downstairs,” I said, “and the suit I’m wearing.”

“No, no, I wouldn’t take your bike or your suit.”

He also expressed concern about the dangers of the poorer neighborhood where I live — a concern beyond his responsibility.

“I guess I’ll have to do what I believe is right,” I said when he was leaving, “and, friend, you will have to do what you believe is right.”

He left without collecting the overdue tax or taking any of my property.

- In the issue, he penned another exhortation: “Let us, like Friends through the years, blaze the trail and set the example for others, rather than wait until there are masses of people taking this action.” He recommended redirecting taxes to the American Friends Service Committee or the Friends Committee on National Legislation, which “will do a much better job of putting our beliefs into action than does the Pentagon.”

- David & Jan Hartsough returned to the Journal in with a letter expressing the same basic argument, and giving some details as to how their tax resistance technique had evolved: “Each year we write a check to the Department of Human Services (rather than the IRS) for the 50 percent of our taxes that we do pay. Along with the check, we send our 1040 form to the IRS and ask them to spend all that money for healing and education, not for killing. And the other 50 percent (the war portion), we refuse to pay. Instead, we contribute those funds to organizations helping to feed the hungry, heal the sick, house the homeless, and work for justice and peace in the world.”