I got four letters from the IRS that purported to sum up my total unpaid taxes, along with interest & penalties, for , , , and .

Their numbers didn’t add up consistently even within their own printouts, though, so I thought I’d dig a little deeper. I requested my “tax account transcripts” for those years from the IRS. (This is easy to do: you can request your transcripts from the IRS website.) They arrived on (in four separate envelopes, naturally, as the agency’s way of reminding me how respectfully it spends taxpayer dollars).

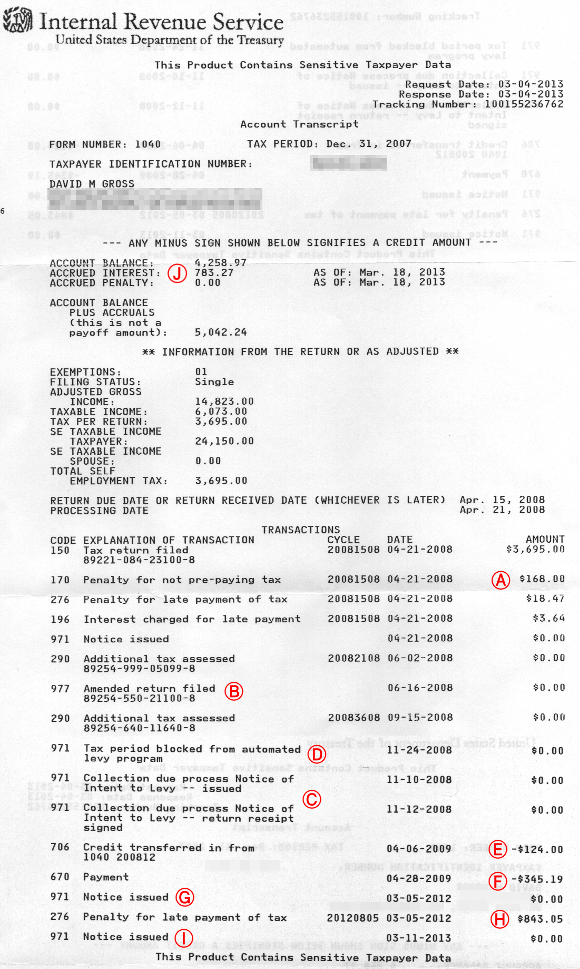

These are interesting artifacts, but in many ways they only add to my bewilderment. I’ll show you one of the transcripts they sent me below, and add some comments and explanations. The original transcript was two pages — I’ve pasted them together in this illustration. I added the red circled letters for my annotations below:

First, a note: In there was a weird glitch in which the IRS erased the “personal exemption” from my return. Perhaps somebody tried to claim me as a dependent on their tax return, or accidentally filled in my social security number for that of their actual dependent, or maybe it was just a snafu — I never did get an explanation. I simply filed an amended return reinstating my personal exemption and left it at that. It didn’t effect the bottom line in any case, so I didn’t give it much thought afterwards.

The transcript shows my initial tax assessment ($3,695.00), the penalty immediately assessed on me for not having paid any of this in quarterly installments ($168), the initial late payment penalty for not having enclosed a check with my tax return ($18.47), and a small amount of interest that had accumulated at the time of their first delinquency notice to me ($3.64). All of that matches my records. (Ⓐ)

The transcript shows no further activity until , but I actually got another notice in from the Agency, at which time an additional $40.83 in interest & penalties had accrued.

In June they erased my personal exemption, then took note of my amended return in which I reinstated it (Ⓑ). I didn’t get official word that they’d accepted my amended return until . I think their phrase for “we changed the numbers on your tax return” is “Additional tax assessed” since it appears twice on the transcript around here, once to omit the personal exemption and once to reinstate it, though neither of these occasions actually resulted in an assessment of additional tax.

On I got an “Intent to Levy” letter from the IRS for the tax year. This also does not show up on the transcript. That letter listed $166.28 in accumulated penalties and $98.46 in accumulated interest, and asserted that my original tax due was $3,885.11 (which actually is the amount of my original tax due, plus the failure to file quarterly penalty, plus the initial late payment penalty, plus the first amount of interest that accumulated).

On I got a “final notice of intent to levy” letter. This is mentioned in the transcript: both the date it was issued, and the date the IRS was notified that I signed for the letter (Ⓒ). By this time, the accumulated penalties & interest on the original $3,695 tax bill had risen to a bit over $572.

Here something peculiar shows up in the transcript: “Tax period blocked from automated levy program” (Ⓓ). This, just two weeks after they’d issued me a “final notice of intent to levy.” I’m not sure how to interpret this. (Note also that this appears out of chronological order in the transcript, just from perverseness I suspect.) There’s also one of these on my transcript.

When I filed my return in (for the tax year) I had so little income to report that I actually was one of those “lucky duckies” who not only owed no taxes but qualified for a refundable earned income tax credit: a whole $124. The IRS seized this refund and applied it to my unpaid taxes. This shows up on the transcript (Ⓔ).

They also credit me for a “Payment” of $345.19 on (Ⓕ). This was actually a levy of a bank account of mine… so apparently that “block” issued in had been released or had expired by then, or perhaps this levy was not one of the “automated” variety.

I got another letter from the IRS in complaining about the unpaid balance, and then another in . These don’t show up in the transcript either.

The IRS tried to seize another bank account , but I’d long since closed it. By then, the interest and penalties had risen to $985.14. Neither an indication of the levy attempt, nor any amounts of interest & penalties from this period show up on the transcript.

The agency sent me another letter in that doesn’t show up in the transcripts. In , they tried to levy money from the brokerage that holds my retirement accounts to apply to my taxes, but they didn’t try to seize the retirement accounts themselves, and I didn’t have anything else there to seize. That, too, is nowhere to be seen in the transcript.

The next thing that does show up in the transcript, after , is a “reminder of overdue taxes” that they sent me (Ⓖ). This is accompanied, in the transcript, with a late payment penalty of $843.05 (Ⓗ). The transcript also notes the letter it sent me , though it gets the date wrong (Ⓘ).

The transcript also has a summing-up section (Ⓙ), which just makes things worse:

ACCOUNT BALANCE: 4,258.97

ACCRUED INTEREST: 783.27

ACCRUED PENALTY: 0.00ACCOUNT BALANCE PLUS ACCRUALS

(this is not a payoff amount): 5,042.24

Why does the interest “accrue”, but the penalty just gets added to the account balance? If they just are going to add the penalty to the account balance, why do they bother to have an “accrued penalty” line on the transcript? Why, if this is their policy, do I only have a zero accrued penalty amount on my and transcripts, while my and transcripts do show accrued penalties?

The account balance does seem to add up to my original tax owed plus that original set of penalties and interest (Ⓐ), plus the $843.05 in penalties (Ⓗ), minus what they managed to seize from me (Ⓔ) & (Ⓕ). I can’t tell you how surprised I was to find some set of numbers on the page that added up to another number on the page in a semi-intuitive way, though it took me a while to develop the correct formula, and I couldn’t tell you why they stuff that original interest amount in there.

I was a little puzzled at first as to why they stopped assessing penalties , but I think by that point the penalty had reached its legal maximum — 25% of the unpaid amount. From here on out there will be no more penalties on my taxes, though the interest will continue to accrue.